Costumer

Go Live

What is SmartPurse?

SmartPurse is a toolkit to help women get smart with money, protect their future and increase their financial independence. The tools, tips and information on SmartPurse are built from years of practical experience, research and based on real-life insight from real people. The credo of SmartPurse is that financial confidence means independence, opportunities and peace of mind for all.

Why was SmartPurse created?

Talking to thousands of women, we learned that there is no safe and welcoming space for women to discuss the money questions impacting their lives and to get practical help.

Women told us that despite everything that is out there, much of the information provided on money and finance is overwhelming and does not really provide the conclusive answers they need to do to take control of their financial future. As many as 4 out of 10 women told us that they don’t even know where to start with financial planning, and 6 out of 10 young women leave long-term financial responsibilities to their partners.

With a team of global thought leaders specialising in gender equality and finance, we set out to change that - to revolutionise the way women discuss and plan their money.

Company Details

SmartPurse

£500’000

Team

Technology

Model

Swiss

Goals of SmartPurse

We inspire women from all over the world to build fulfilling and financially independent lives by answering their questions and giving them the motivation, knowledge and tools to take control of their financial future with confidence.

How is SmartPurse different from anything out there?

Independent

All in one place

Practical, action-oriented, personalized

Motivating - peace of mind

Helping you save money

Results

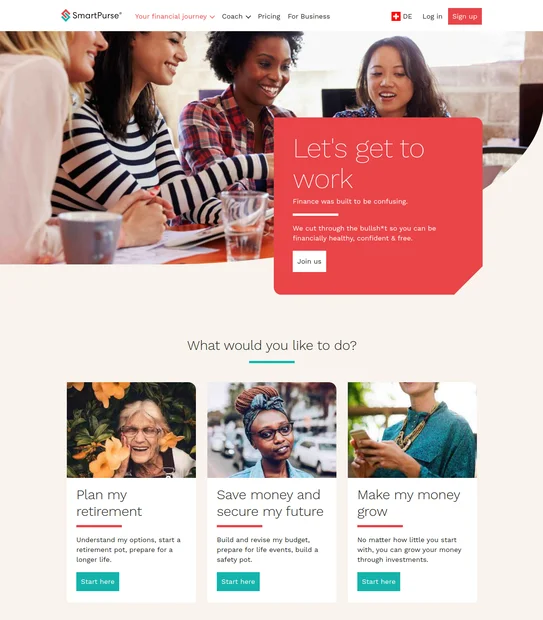

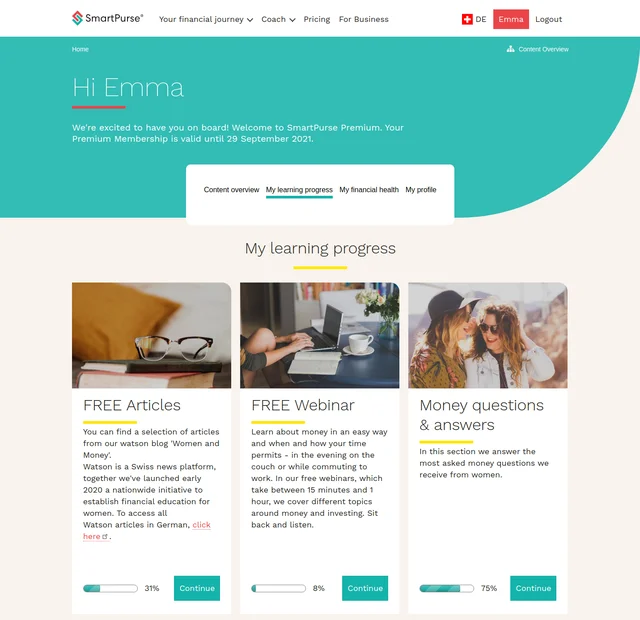

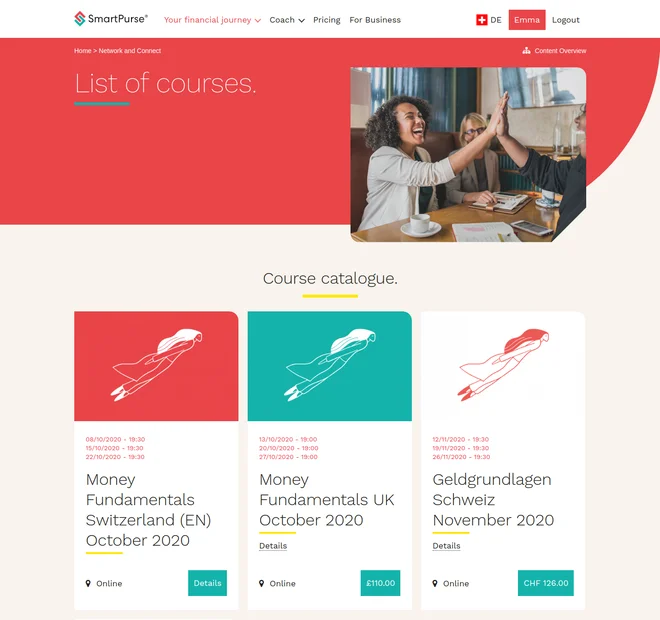

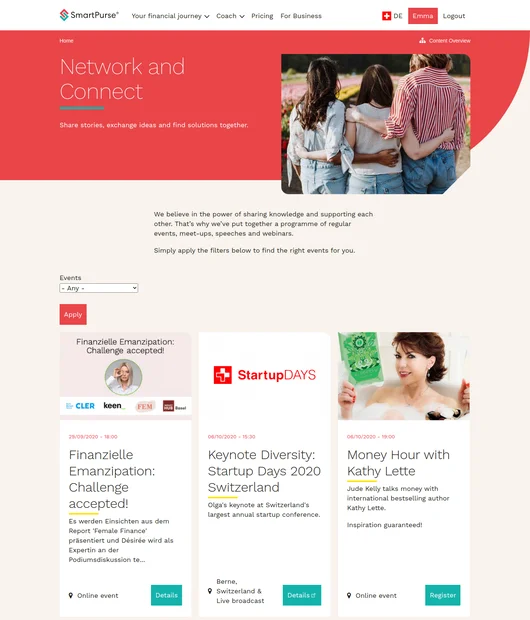

SmartPurse helps women get to grips with money in 3 ways:

"Thanks to Thunder we managed to develop a broadly relevant system that aims to solve the global challenge of financial inclusion with better functionality than any standard learning system. The tech allows us to have a competitive advantage both, in terms of price as well as speed and scale. All at very reasonable costs even a start-up can afford."

Technical challenges

The project was previously implemented with a first design and sample content in Wordpress. After the takeover by MD Systems, the examples were analysed and a concept for the administration and development of the content was developed. Based on the design, modular elements were developed for the implementation in Drupal and the visual identity was refined. For optimal consistency and to minimize complexity in implementation and administration, variants were consolidated as far as possible and automated rules for their application were defined.

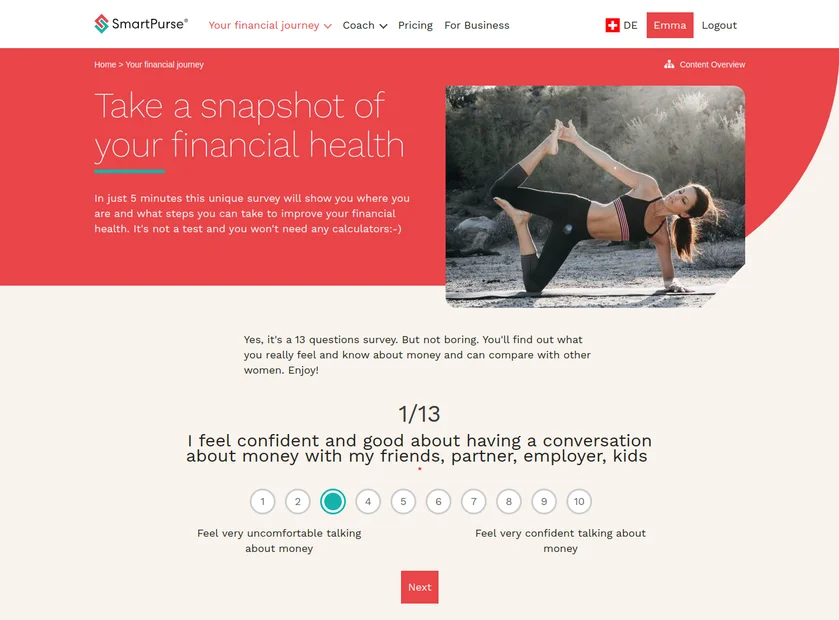

The functionality for tracking and visualizing a user's progress along the learning path was developed from scratch. The granularity of this functionality allows a single page to be divided into several individual steps. After interruption, the user can be returned to continue the path.

The modularity of Drupal and the well thought-out architecture of MD Systems lay the foundation for the planned on-going expansion of the learning functions, provision of an advisor tailored to the personal profile, multilingualism and regionalization of content.

The implementation of automatic recurring settlement on credit cards for memberships proved to be difficult, as providers of payment solutions have recently made major technical changes due to changes in regulations (Strong Customer Authentication). Existing Drupal solutions must first be adapted. To simplify matters, it was decided that monthly memberships can be renewed through an accelerated checkout. Discounted annual subscriptions are also offered for long-term members.

Contributions for the Drupal community

Drupal Core displays internal username

The processes around user registration using usernames or email are not always consistent in Drupal. Often, defining a separate username in addition to first and last name and email is also unnecessarily confusing for users, especially if you can also log in directly with email. Drupal basically allows an application to define how references to the user are displayed (with getDisplayName()). Work has continued on a solution, so that this instrument is respected consistently by Drupal and does not lead to inadvertent display of internal information.

H5P blocks background processes

For interactive "Learning Nuggets" components from H5P are used. A bug was fixed that could cause all background processes (cron) to be blocked.

CAPTCHA blocks registrations

After an update of reCAPTCHA it was found that despite a successful test of the registration, no further registrations by users were made. It turned out that CAPTCHA blocked all following registrations by inadvertently caching the first test parameters. The solution completely deactivates the cache for forms with a CAPTCHA, but has not yet been included in the official release of the module.